Each bank decides the length of time their preapproval last. Constantly, home loan preapproval letters are great for 29, 45, otherwise two months. A few loan providers used to have 90-date termination times and you might nonetheless find one, even when which is less frequent today.

The explanation for this can be that given that documentation used to pre-accept your continues 3 months, the new page is particular into the family an offer is being generated toward, says Jon Meyer, registered MLO together with Home loan Accounts financing professional. So while cost is moving, it does in fact research most useful regarding the bring having an excellent new letter.

Suppose you will be recognized to help you use $250,000 in the an excellent 6.5% price. If the mortgage pricing out of the blue plunge to 8%, your own monthly premiums will be substantially large, and you probably failed to pay for including a giant amount borrowed. Very, whenever cost is actually ascending easily, lenders you’ll shorten brand new authenticity of preapproval emails.

Preapprovals generally speaking can’t be stretched, nonetheless are going to be revived. The real difference would be the fact your financial pointers will need to be re-verified; you can not merely offer your preapproval predicated on previously recorded advice. Of several lenders would want to understand the latest items of your own preapproval records. People become previous spend stubs and you can financial comments, to mention a few.

This type of data have validity timeframes, explains Meyer. Including, their latest financial statements cannot be more two months old.

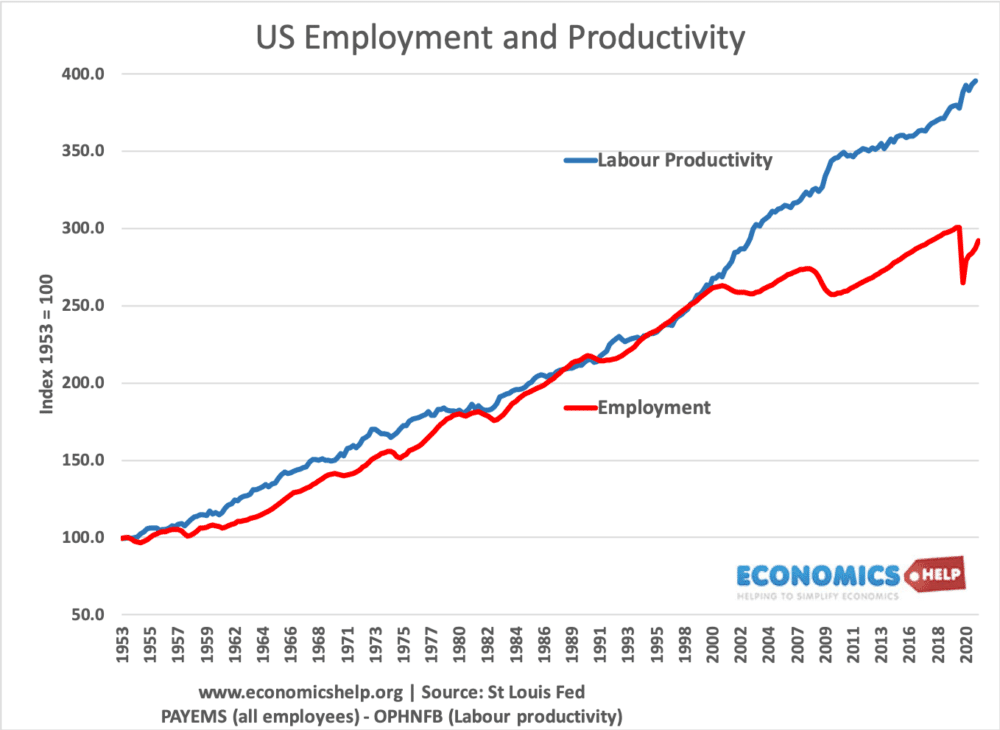

Expect to visit your limit loan amount less if mortgage pricing enjoys risen significantly as you was in fact past preapproved to have a property financing. If this sounds like possible, then you can now just be capable afford a smaller mortgage. While doing so, when the costs keeps dropped since you past got preapproved, which could assist decrease your payment and you may enhance your house-buying funds.

Often multiple preapprovals damage my personal credit score?

Certain lenders manage tough credit concerns once you affect get preapproved. That implies your credit score usually takes a tiny strike per big date (always below 5 facts on the FICO rating).

Should you get preapproved multiple times within this a few weeks – that can occurs if you are looking for home loan pricing – singular difficult query often count up against your credit score. If your preapprovals are dispersed over almost a year while you are family google search, your credit score can take several small strikes.

Certain loan providers generate just an effective delicate borrowing query throughout the preapproval, and this will not affect your score. Even though there was a challenging inquiry afterwards when you implement for the genuine home loan.

Today, less lenders charge costs for preapprovals. Those that carry out always subtract the fee (will $300-$400) from your own best settlement costs, while you get the mortgage from them.

Preapproval compared to prequalification: What’s the variation?

You will probably comprehend the words preapproved and you will prequalified when you start finding your dream home. These include will put interchangeably that confuse people and you will consumers the same, specifically basic-date homebuyers. But really, he could be most different from one another.

- Prequalification is simply an offer based on thinking-advertised financial guidance, whereas an excellent preapproval requires you to submit economic data files to have confirmation

- Mortgage prequalification cannot normally pull your credit report. Alternatively, they spends a good soft eliminate personal loans for bad credit in New Jersey to track down a standard picture of your credit history. Good preapproval comes to an arduous credit check that will feeling your credit rating

- Prequalification will not make certain the debt-to-money ratio (DTI), however, a good preapproval have a tendency to. Borrowers having an effective DTI lower than 43% are usually qualified to receive antique fund, along with bodies-backed FHA, Virtual assistant, and you may USDA funds

Getting a great prequalification is fast and simple. However the more time it requires towards preapproval techniques are more than likely worth every penny.